Adi Cohen, themarker.com

Significant distortions were found in 8.3% of the real estate transactions that were delivered to the tax authority, and were made public by estimates of NIS 200 million a year, according to a study conducted at the Alrov Institute for Handel Studies at theKolmarker Faculty of Management at Tel Aviv University, which was first revealed in the the-the "the." According to estimates, about 8% of real estate deals reported over the past two decades, there is a real potential for a 30% average tax evasion. In this way, a study by the real Estate director's office indicates that significant distortions in the tax authority data exist as well as the size of the apartments. It should be noted that the entire real estate industry relies on the tax authority's information database, so that defects in reports have a acute effect on the reliability of the price indices on which the market relies.

Prof. Dani Ben-Shahar, head of the Elrov Institute for Handel Research at the Kolman School of Management at Tel Aviv University, led the research with his colleagues Dr. Roni Golan and Dr. Eyal Solgennik. He tellsThemarker that "the findings of the study constitute a real indication that many of the prices reported to the tax authority in real estate transactions – are not true reports, which has many meanings on the market." He explains that "in a situation where there is a shortage of information about market prices – the efficiency and certainty of the market are the victims."

Ben Shahar says that the missing reports found in the Alrov Institute's research also have a substantial and proven effect on the public register: "The findings show damage to purchase tax payments in the magnitude of 2.5% – 6.3% of their income." For example, in 2016, there were income tax revenues in Israel in the magnitude of 1.1 billion – that is, loss of purchase tax revenue of 28 – $70 million in terms of 2016 only. On average, it's about 50 million being dragged from the public cashier every year. This should be added to the loss of a praise-tax income – for which we have no appreciation at this stage. Ben Shahar added that "clear me a language and there are errors in the report, but it is unlikely that it will be the situation in such mass of deals." I am convinced that at least part of it was reported intentionally.

The tax authority considers adopting the pilot

In the study, approximately 1.2 million reports have been examined for the tax authority over the past two decades. About 58 cities throughout the country have been selected for research-such with high concentrations of deals, through which it was possible to produce a statistical assessment of market prices in different time periods. In the 58 of these cities, the interrogators chose about 51 thousand assets in which a recurring sales service was recorded that the property was sold at least twice over the years that were examined.

In order to find the most significant defects and deficiencies in the price reports, the researchers created a statistical formula that examines the ratio of the apartment's price to the market price during various time periods where the apartment was sold – and the extent of the gaps between them, while referring to the variables such as the increase of prices, the time elapsed between the deals and the like.

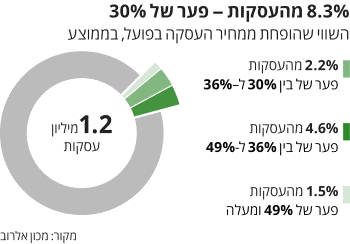

"We have developed a formula that we can evaluate missing reports — that is, reports of an apartment price that is lower than its real price", explains Ben-Shahar. He added that "we investigated through this formula the data of all real estate deals reported to the tax authority from 1998 to 2015. We found that 8.3% of the transactions in Israel that were carried out over these years-were reported at a missing price, which was 30% lower than the price of the apartment's truth. The reports in 4.5% of the transactions were even worse — with a reduction in the reporting of more than 36% on average from the real price. 1.5% of the transactions were reported at an average price of 50% less than the price of the apartment in the market.

In these days, the tax Authority is examining the possibility of implementing this formula with criticisms and inspection procedures that are done on the dealing reports – a pilot that will help the tax authority to discover cases of scams and tax evasion.

Immediate suspects: First apartment buyers

Ben-Shahar says that as of this stage, the data is not being segmentation according to cities, but it is found in its research that as a rule, "the tendency to be suspicious in the sub-report to the tax authority has risen significantly in areas that are at a low socio-economic level, where the percentage of crime per capita; And as much as the tax should be paid, it is greater. On the other hand, we found that investors-two apartments and more – are less likely to have missing reports, and that these are often made by first apartment buyers.

The issue of distortions in reports of real estate transactions to the tax authorities is not new. For example, a test similar to the one held at the Elrov Institute was made by the State Comptroller in 2007, when reports of about 20,000 land transactions were given to the tax authorities from April to July in the same year. The data and prices reported were tested by the tax authority's appraiser, which found that approximately 17% of the price reported was less than 30% lower than the real market price.

On 2015, the subject received further attention in the state Comptroller report, where he criticized the limited tax authority and control capability. It also criticized the lack of coordination between the various bodies in the trust market for collecting and concentrating data in the real-estate industry, which create deficiencies, contradictions, and distortions in the existing database.

In 2017, the Ministry of Finance also published a report that reviewed the flaws to which the State Comptroller addressed the issue of distortions in the data, where it was argued to "fear that a large black capital is invested in the real estate industry in Israel." The severity of the subject and the importance of the treatment explained in the report of the Treasury in the fact that "the Struggle for Black fortune" in particular, in real estate, it can increase the collection potential of real estate taxes, income tax and VAT. Also, the funds not reported to the tax authorities have a part in the real estate market, and may lead to an additional increase in real estate prices.

It seems that in the past year the state has raised a "gear" in the fight against the peripheral black Capital invested in the real estate industry and its significant impact on the entire industry. For example, as part of this struggle, the state's policy in the beginning of the current year, the first of the cash law limits the height of the deals that are permitted for a cash payment of about NIS 11 thousand shekels.

"The high potential of tax evasion in real estate transactions stems from the fact that it is dealing with the purchase tax payment and the capital is a significant amount, so the temptation is to commit a tax offence," said CPA Iris Stark. Many are not cities for the easing of the size of an apartment, whether this is a first apartment, a reference to a married couple and more.

"There is control and supervision that in recent years has been exiled and confiscated-there has been a worsening enforcement of criminal tax offenses, and today they are considered a source of the prohibition on Money Laundering law and punishment is particularly stringent." Also, the reduction of cash usage law makes it difficult to transfer significant sums of money without identifying their source. However, there is still insufficient manpower in the tax authorities to check and visit the reports. The economic significance of the disappearance of taxes, including taxation on real estate transactions, is that the state budget based on the taxes is damaged-and the tax burden is more taxing on thetaxpayers' law.

The tax authority has stated that "in recent years, the database of transactions reported to the Palestinian Authority has been substantially improved." The PA operates in cooperation with other governmental bodies to continue to improve the database of reported transactions. However, it must be remembered that the data reported to the tax authority is based on the statement of the parties to the transaction for the purpose of issuing a tax, when the case examination is derived from various criteria and lessons produced over the years.

The Central Bureau of Statistics has been reported: "The Bureau is continually working on improving and cleansing its data, including those used to calculate apartment prices indices." In the last two years, the latter has made a long way to improve data bases and publish quality indices.

Mismeasure

In this case, another study that was recently conducted by the Israel Real Estate agency indicates that significant distortions in reports to the tax authorities also exist in the data on the size of the apartments – in a manner that influences, among other things, the price indices in the industry, including those of the M.

These distortions also impair the credibility of the information in the industry, since the reports are supposed to reflect the market data, and they are determined by the housing policy, and the decisions of people who are engaged in the field, business people, and individuals who buy and sell apartments.

The test, which was first exposed in the Land-Mmtzaya conference held at the end of last month in Eilat, included 200 apartments sold in 2019. The examination found that 20% of the meter's records on the size of the apartment were found to be incorrect.

For example, an apartment in Petach Tikva, which was reported to the tax authority on an area of 82.2 sqm – was found in the examination of the Bureau as an area of 118 sqm. According to the tax authority, the reported value of sqm in this apartment is 17.6 thousand shekels, while in practice, the price is 12.2 thousand shekels per second. Another apartment, in Ashdod, which was reported in a position of 42 sqm to 2.5 rooms – was found in the same framework as the 4-room apartment split into 3 residential units, in the area of 102 sqm-more than double the reported territory. According to the tax authority, the price per m in this apartment is 26.6 thousand shekels – compared to the actual price that is 10.9 thousand shekels only.

Haim Masimai, chairman of the Israel Real Estate appraisers office, says, "if it were a single percentage." But the significance of such a scale in the distortions of data is insane. In fact, when one or another factor declares that the prices in the housing market increased by 0.5% or decreased by 1.5%, he did not know what he was talking about; He cannot know, it is based on completely distorted data. In this case, these are the data that the entire real estate industry uses and relies on them – projects and other professionals, through the path to the Ministry of Finance.

Misiai explains the faulty reports of the gaps between the measurement systems used in the market, as well as the "reliability" of the information that also exists in the Land Registry (the taboo), on which many of the apartments are relying on reports. "Whether it is a person who is familiar with his apartment or lawyer who is reporting to the tax authority on the deal that was performed – the details that are usually given will be based on the formulation of the taboo or the Arnona form, and sometimes even the discourse between the seller and the buyer alone," he said. According to him, "in many cases, the gap between the data of an asset as shown in the taboo and reality is enormous." Some of this stems from changes made over the years in the measurement and registration methods. For example, in the past, the terraces were not recorded as part of the apartment and today they are. But beyond the altered methods, the main cause of these gaps is the lack of contact between the planning plane of the construction industry to register with the real estate registry. The person who receives a permit to expand the area of the apartment is not obligated to register the change in the Land Registry (taboo) and thus formed a gap between what was recorded in the local authority for taxes on the registration of the real Estate registry.

Advocate Eliran Dadon, head of the Municipal taxation department and the Israel Lands and partner in the firm Gindi-Caspi: "There are gaps in the measurement systems of the apartment area. There is a measurement for the purpose of the selling law, measuring for the purpose of the need, there is a measurement for registration in the land, and there is a measurement for the purpose of Arnona. These four different measurement methods differ from each other, and people go with what they have or sometimes with what's best for them. Distorted data, conflicting information and uncertainty create confusion, and in the real-estate market-confusion creates a risk.

According to my letter, "the solution is to create a unified database for the apartment area." We are promoting the tax authority a proposal to include an appraiser form in the reporting process of a transaction, or an attorney will be charged to submit.