Eric Mirowski,globes.co.il

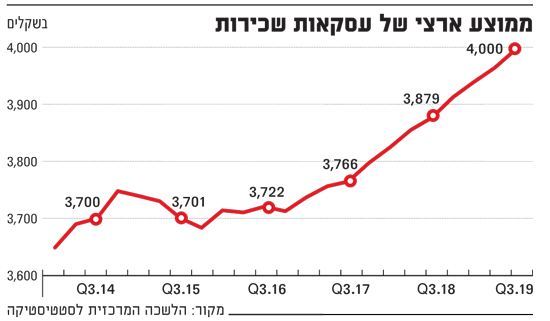

The average price of rent continues to rise to a peak of NIS 4,000 per month in the third quarter of 2019, according to data published by the Central Bureau of Statistics (CBS). In the past year, the rent index has risen by only 1.6%, but with a five-year view This is a 10% increase.

In relation to the rate of increase in housing prices, this is a relatively low increase, but it is still an increase that raised the average annual rent by NIS 4,500 on average.

According to CBS data, the most expensive area for renting is Tel Aviv District, with an average rent of NIS 5,865 per month, while the Haifa area is the cheapest area, with an average rent of NIS 2,538.

National average of rental transactions

National average of rental transactions

According to market estimates, the rate of increase in rental prices should have been higher, mainly due to the dwindling supply due to intensive sales of apartments by investors. According to the chief economist at the Ministry of Finance since the second half of 2016, the number of apartments held by investors has dropped by about 20,000.The main reasons for the sale of apartments are the heavier tax burden on investors and estimates that house prices will not rise at the rate of increases since the beginning of the decade.

However, CBS data suggests that these estimates were incorrect, and sales are likely to be made primarily in places where investors have concluded that demand for them will not be high.

The most popular mistake of investors in recent years has been to buy apartments in low-cost projects on the periphery, just because of the cheap prices, and regardless of the market rental conditions on the premises. The result: an attack by investors on places characterized by a small rental market, creating surplus.

For example, new projects in Kiryat Gat were a target for investors in early 2015, mainly because of their affordable housing prices. Treasury figures show that 280 apartments were purchased by investors during that period, but to date, more than 10% have been sold. At that time, Afula was also a target sought by investors due to the low prices, but the city was flooded with flats, and evidence from the realm of realtors indicates that investors prefer to sell the apartments there.

At the same time, price declines were also recorded in specific locations. According to the yad2 table at the end of 2015, the rent of a 4-room apartment in Afula reached an average of NIS 2,730, at the end of last year it fell to an average of NIS 2,500, and today apartments can be found at lower prices. Many apartments in the periphery remain vacant and their owners find it difficult to rent.

When it comes to the overall national index, these declines offset increases recorded in demand areas, and thus the overall index indicates an upward crawl.

Quarterly segmentation of rental transactions conducted by the CBS that distinguishes different regions indicates that price changes are not uniform: in the year that passed between the third quarter of 2018 and the third quarter of 2019, rental prices for 3.5-4 room apartments in the Northern District and in Haifa rose by 1.4 Only three percent of these areas, especially the area of curiosity, are in the process of flooding in the apartments, mainly of housing cost, but many of them have not yet been populated. Of the purchasers, they are investors.

In contrast, in demand areas, rental rates continue to rise at a faster rate. Gush Dan, that is, the cities surrounding Tel Aviv prices rose by 4.2%, in the Tel Aviv area they rose by 3.4% and Jerusalem by 3%.

The southern region actually recorded a significant 3.5% increase in rental prices. A possible explanation for this unusual increase is that this area is defined as being just south of Ashdod. The cities of Ashdod and Ashkelon have in recent years become a remote Tel Aviv periphery and a destination for investors and renters. It is possible that a large portion of the rental contracts signed in the year between the third quarter of 2018 and 2019 were made on new apartments in these locations.