The Marker, Hadar Horesh, 29.06.2021

Are apartment investors pulling prices up? A survey conducted by the Chief Economist's Division of the Ministry of Finance reveals inconclusive results: Although investors are competing for the same apartments that young couples are also interested in buying, it turns out that investors buy them at a lower price, on average. Besides, last April, the stock of apartments held by investors even shrank.

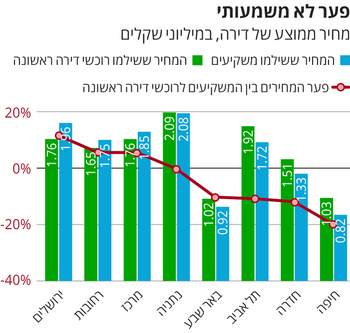

According to a review published today (Tuesday) by the Chief Economist Division, the average price paid by investors for second-hand apartments is about 5% lower than that paid by first-time home buyers for such apartments. This finding undermines the assumption that demand from investors pulls apartment prices upward, even though demand on their part contributes to the market situation.

An examination of the average income of investors revealed an unsurprising finding: their average income (NIS 39,000 per month per household) is higher than the income of young couples competing for the same apartments (NIS 27,000 per month). The competition between the two groups for the same stock of apartments is also not surprising, since the young couples are the ones who also rent apartments from investors.

One way or another, investors are not just buying apartments. Their sales in April totaled 2,200 apartments, which means that the stock of apartments held by investors decreased in April by about 300 apartments. These data raise questions about the usefulness of the Bank of Israel's initiative to limit the activity of investors in the housing market.

Rumors of a decline in Beer Sheva's fund as the capital of investors were probably too early. The Beer Sheva area stands out with a 153% increase in investor acquisitions compared to April 2019. Netanya is not much behind it - and investor acquisitions in it have jumped by 140%.

Great benefit in price per occupant

Buyers of apartments as part of a price-per-tenant program continue to receive large discounts compared to market prices. In Kiryat Ono, for example, the first apartments were recently sold by Ashdar as part of price-per-tenant tenders, and the average price per apartment in the plan was NIS 1.5 million, 39% below the current average price per apartment in the city. According to calculations by the Ministry of Finance, the average benefit for buyers of these apartments amounted to NIS 585,000.

According to the economists of the Ministry of Finance, this is one of the large gaps recorded between the price paid by those entitled to a price per occupant and the prices of apartments in the free market. Due to even higher gaps recorded last year in tenders of the Israel Land Authority (RMI) in Or Yehuda and Ramla, the maximum discount that contractors are allowed to give to apartment buyers was limited.

Chief Economist at the Ministry of Finance, Shira Greenberg Photo: Shauli Landner

The chief economist's examination shows that the huge benefit in Kiryat Ono did not actually reach the most needy population. The wage levels of buyers of discounted apartments in Kiryat Ono did not differ significantly from those of buyers of apartments in the free market. The average salary of the apartment grills was NIS 24,000 gross per household - only 7% lower than the average salary of first-time home buyers in the free market.

Strong market

The housing market continued to be strong in April 2021, but did not break records. In April, 10,900 apartments were sold in the market - a decrease of 17% compared to March, but an increase of 34% compared to April 2019. The Ministry of Finance avoided a comparison to April 2020, in which activity was affected as a result of the first closure due to the Corona plague.

Move to Gallery View

Price per occupant project in Kiryat Motzkin. Big discounts compared to market prices Photo: Doron Golan

Free market sales (less occupant price transactions) totaled 9,500 apartments last April, an increase of 35% compared to April 2019. Investor activity in apartments fell sharply compared to the peak month in March. Investors purchased 1,900 apartments in April, down 21% from the previous month. The share of investors in the market fell slightly from 19% in the previous month to 18%. However, compared to April 2019, the activity of investors in apartments has increased greatly, partly due to the tax relief granted to them in July 2020. Investor purchases have almost doubled compared to April 2019.

April was a relatively weak month compared to its predecessor in the area of new apartments. Contractors' sales amounted to 4,100 apartments - a decrease of 22% compared to the previous month, but an increase of 44% compared to April 2019. About a third (34%) of sales were within the price per occupant program, and sales in the free market amounted to only 2,700 apartments, a decrease of 23 % Compared to the previous month and an increase of 51% compared to April 2019.

Sales in the Tel Aviv area stood out in a sharp increase compared to other areas due to a sales operation in a residential project of the Azorim construction company. However, compared to April 2019, there was an increase in sales in all regions of the country except Tiberias.