Calcalist, Dotan Levy 06.01.2021

While residential real estate developers have been reporting an onslaught from homebuyers in recent months as well, the rental market is transmitting weakness with a downward trend in prices. At the same time, private companies collecting data on the rental market, which is not steeped in databases, indicate a change in the trend in rental prices since the outbreak of the corona.

Read the Calcalist newspaper printed directly from the app at a price of NIS 29.90 per month

Unlike the sales market - which enjoys expectations of further price increases (against the background of declining land markets and construction starts), tax cuts for investors in July and favorable financing conditions in the mortgage market - the rental industry is mainly affected by the labor market and tenants' salaries. Also against the background of a forecast that the interest rate will continue for a long time to sail at low levels, the decline in the rate of return from renting an apartment below 3% (gross) no longer sounds unfounded to investors.

According to data from WeCheck, which is controlled by Yad2 and Isracard and provides information and insurance services in the apartment rental market, the rental market in Tel Aviv has been hit harder than the national average. Since April, many previously rented short-term apartments such as Airbnb have entered the rental market in Tel Aviv, as well as apartments whose tenants were financially damaged and preferred to return to their parents or look for other housing solutions.

According to Different, which provides rent insurance, about 10% of landlords have lost income in recent months because of a tenant who did not pay rent or refused to vacate, most of them due to the effects of the economic crisis.

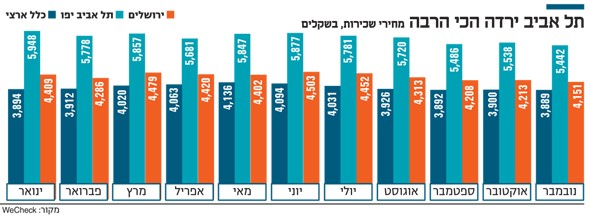

In an annual summary, according to WeCheck, in Tel Aviv, a price decrease of about 8.5% was recorded, from a level of NIS 5,950 on average to NIS 5,450, similar to the level of rent in 2018. Jerusalem was characterized by relative stability until June, but in annual average the rent there fell by 3.5%, from NIS 4,400 at the beginning of 2020 to NIS 4,250 on average today. There were increases in Be'er Sheva until May, but from June there was a decrease of 7.6% to an average of NIS 2,750, a decrease of about 3% on an annual basis.

According to Rami Ronen, CEO and founder of WeCheck, the fundamental change is that the bargaining power has passed to tenants. This is despite the fact that according to recently published finance data, from April 2016 to October 2020, 27,000 apartments for rent were deducted from the market.

Rami Ronen Founder and CEO of WeCheck Photo: PhotoPage

The corona crisis has also changed patterns in the rental market, for example traditional rental dates have changed slightly. During normal periods, most rentals close before October, ie before the start of the school year, while in 2020 there was an unusual increase in the supply of rental properties in October and November, which may indicate that students and families rented fewer apartments during this period or left their apartment in mid-contract. It is estimated that the upward trend in the supply of assets will continue in 2021.

Another interesting phenomenon is a decrease in rental prices in parallel with an increase in price per square meter. The study explains this by the high demand for smaller apartments over larger apartments: the requested apartment size decreased from 84 square meters on average to 78 square meters.