The Marker, Sami Peretz, 22.12.2020

The Governor of the Bank of Israel, Prof. Amir Yaron, closed two years this week. His acquaintances and friends in the United States, where he has lived for the past 20 years, ask him how he is from time to time, to which he replies: "I live like a dog, every year here is like seven."

Yaron was appointed governor during a dull period, when it seemed that his job would amount to coming to the office once a month to decide on the level of interest. But since his appointment he has faced three election campaigns, a huge corona crisis and the retirement of several central bank executives.

Yaron was required to briefly study the Israeli economy, which he knew from a distance due to his thriving academic career in the United States . Which can lead to a lot of moves quickly and without bureaucracy.

A significant step in the housing market

Since the beginning of the Corona crisis, the Bank, led by Yaron, has led a series of actions to stabilize the financial markets, which included liquid inflows to banks, purchases of tens of billions of shekels in government and corporate bonds, encouraging loans to affected businesses and sending a general message to the banking system. Financial crisis At the same time, Yaron pressured the government to act quickly, for example, in an argument between Finance Minister Israel Katz and the head of the budget department, Shaul Meridor, who resigned.

The financing reliefs occupy the economy just when the housing supply is declining, following a reduction in the purchase tax for apartment investors. The possible result is a rise in prices

Yaron's quick and determined actions have earned him praise from the International Monetary Fund and rating agencies . Even the banks, which were not so connected to him at the beginning of his career, quickly learned that he is a brilliant economist who understands well the new reality created by the crisis.

Also last week, when Shiron announced his most significant step so far in the housing market - he did, on the face of it, the right thing. But this may have been Yaron's biggest mistake since the outbreak of the crisis. The Bank of Israel has announced that it is abolishing the existing restriction on taking out mortgages, according to which only up to one third of the total loan can be linked to the prime interest rate. The decision is intended to facilitate borrowers and support the resumption of demand for apartments.

The restriction on the mortgage share linked to the prime interest rate was born during the time of Governor Stanley Fischer, and its purpose was to prevent a deterioration in the situation of borrowers due to a possible rise in interest rates. The interest rate, as is well known, has not risen since then - and the chances of it rising in the foreseeable future are very low. Therefore, as part of the search for ways to facilitate borrowers, release restrictions and motivate economic activity - the restriction is about to be abolished.

Construction project in Jerusalem Photo: Tomer Applebaum

This is an important line for anyone who has a mortgage, or intends to take one, because it will lower the monthly repayment and free up resources for consumption or savings. But there is one problem: the relief in financing is taking over the economy just when the housing supply is declining, following a reduction in the purchase tax for apartment investors. The possible result is a rise in apartment prices.

Apparently, the rise in apartment prices is not perceived as a real economic problem as long as it occurs in a moderate manner and in accordance with the rise in the standard of living. As long as the banking system enjoys large capital cushions and provides loans at reasonable financing rates, the rise in apartment prices is also not a financial problem.

Transportation loads and increase in inequality

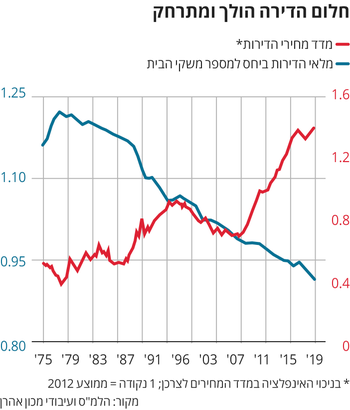

The Bank of Israel has taken quite a few moves in the last decade to ensure that the system is able to withstand major shocks in the housing market - especially in the event of a collapse in their prices. The problem is that the prices of apartments in Israel are very high, after their price doubled within a decade, which keeps many away from the possibility of buying an apartment. However, the central bank does not see the cost of housing as a problem, because it trusts financial stability and price stability in the economy.

The choice of the governor and the Supervisor of Banks, Yair Avidan, to go at this time on easing the terms of housing loans, effectively ignores the government’s failure to reduce construction starts. According to CBS data, between October 2019 and September 2020, there was a 9.5% decrease in construction starts, compared to the previous 12 months.

Construction in Kiryat Motzkin Photo: Doron Golan

The Aharon Institute published a forecast in October that apartment prices will increase by 6% in 2021 compared to the second quarter of 2020. The researchers, Prof. Zvi Eckstein and Dr. Sergei Somkin, note that this is a deviation of 21% from apartment prices, compared to the trend line. In the standard of living, the deviation means continuous damage to households, which entails the construction of housing far from employment centers, transport congestion and an increase in inequality.

The researchers explain that the main reason for the rise in housing prices is the gap between the quarterly increase in the number of new households and the increase in the number of dwellings whose construction has been completed. According to the analysis, in the last five years, 15,000 new households have been added to Israel every quarter - compared with 12.5 thousand apartments. The researchers state that in order to close the gap and curb the rise in apartment prices, 20,000 apartments must be built every quarter for the next five years - especially in the center of the country.

Double-digit price increase

The Aharon Institute's analysis was published before the Bank of Israel announced its intention to facilitate the provision of prime-rate loans. This means that since the analysis, which predicted a 6% increase in apartment prices, there has been a new development that supports increasing demand.

The president of the Contractors Association, Raul Srugo, believes that removing the prime limit is mainly intended to alleviate borrowers who have run into difficulties due to the corona crisis, but at the same time he estimates that government failures in real estate will lead to double-digit housing prices in the coming year. Is in a catastrophic situation due to shortage of workers, delay in approving urban renewal plans and in marketing and land planning.

Yair Avidan Photo: Bank of Israel Spokeswoman

The contractors, the Bank of Israel and the researchers at the Aharon Institute expect the government to do its part and address the supply side - through land marketing and planning, promoting urban renewal, transferring powers to local government, promoting productivity and efficiency through industrialization and more.

It is a bit excessive to expect something from this dysfunctional government, which is about to end its days, but it is clear to everyone that it is the address for the state of the construction industry. Thus, while the governor's decision is coherent and integrates with the other steps he is taking to stabilize the economy, encourage demand and prevent business collapse, it is inconsistent with the steps the government is not taking to increase the supply of apartments.

At this stage, the question arises as to whether while the government is not doing its job on the supply side, the Bank of Israel is expected not to take measures that encourage demand - in order to maintain equilibrium that will prevent a jump in housing prices. The central bank is an independent body that does what it sees fit for the benefit of the economy and its goals: maintaining financial stability and price stability. In the coming year, we will know whether the current move with the prime interest rate helped the Bank of Israel achieve its goals or sabotaged them.