Calcalist, Amitay Gazit, 01.10.2020

The government's paralysis in the Corona crisis will lead to a sharp decline in the number of apartments to be built in the coming years , according to a Calcalist survey. While the demand for housing remains rigid, despite the health and economic crisis, the Israel Land Authority (RMI) has not been able to keep pace with land marketing in recent years, or even close to it - which in turn could lead to severe supply shortages and rising prices.

From the beginning of the year until September 22, Rami signed deals for the sale of plots for developers to build only 17,000 apartments, 37% less than in the corresponding period last year, when deals for the construction of 27,000 apartments were closed. In view of the beginning of a second closure, the end of which is unknown and makes it very difficult for Rami's efforts to close deals, and in view of the political failure, it seems that by the end of the year the gap will not close, perhaps even deepen. Rami ended 2019 with 38.8 thousand apartments in signed transactions, after publishing tenders for the construction of 56,000 apartments. On the other hand, so far Rami has issued tenders for the construction of only 25,000 apartments, while in the corresponding period last year, tenders for the construction of 29,000 apartments have already been published, a negative gap of about 13%.

The government dysfunction, for which the finance minister has not yet signed the housing plan and the new tender system led by the resigning housing minister Yaakov Litzman (who is expected to return soon as deputy minister with ministerial powers) - will only exacerbate the gap between supply and demand. The plan was approved three weeks ago by the Israel Lands Council, but without the signature of the Minister of Finance, Remi has no legal ability to close tenders.

Apart from the dispute with the Treasury, which is delaying tenders, the second closure forced Rami to postpone the closing dates of the tenders. 42 tenders are currently ready for closing, after brochures with the rules of the tender have already been published, but at this stage it was decided that due to the closure none of these tenders will be closed at least until mid-October. At the same time, Rami is still working to complete the transactions that were rejected during the previous closure period. Tenders will be postponed and so will the payment dates, so it is expected that some of the proceeds from tenders closed this year will be received by Rami only in the first quarter of 2021.

Rami adheres to the decision to postpone the dates of the tenders, mainly due to the technical difficulty of entrepreneurs in receiving guarantee letters from the banks during the period of closure and with the thought that in a period of economic uncertainty the chances of success of the tenders are relatively low. But in any case, Rami cannot close tenders now, mainly due to the lack of a state budget and the postponement of the vote on the Arrangements Law - which requires Rami to negotiate with the Treasury on any reform and indicate a budget source for each move.

Earlier this month, the Israel Lands Council, headed by former Housing Minister Yaakov Litzman, approved the new housing plan that will replace the price per occupant and includes a discount on apartments, grants and subsidies. But this plan did not come into force at all due to the lack of signature of the Minister of Finance. Currently, there are still slow negotiations between the Ministry of Finance and Rami and the Ministry of Housing on essential details of the plan, including the level of discounts and subsidies.

Minister of Finance Israel Katz. Signature inhibitorPhoto: Avi Mualem

Minister of Finance Israel Katz. Signature inhibitorPhoto: Avi Mualem

There are no sources of funding

The dispute between the Ministry of Finance and the Ministry of Construction and Rami also affects old tenders published in the price per occupant. On the face of it, it should not be a problem to close tenders from the days of price per occupant, but as revealed in "Calcalist", in theabsence of a budget source, it is impossible to close the tenders that require grants and subsidies. These are mainly 15 tenders for the construction of about 5,800 apartments, which include grants of NIS 60,000-40,000 for the buyers of the apartments, as well as an additional NIS 40,000 for each apartment that is given as a subsidy to contractors for development. According to the law, in order to close them, the government must indicate a budget source for funding grants and a development subsidy of about NIS 500 million.

Apart from all this, another problem of Rami this year is that 50% of its manpower is disabled due to the emergency regulations of the Corona period, and the remaining workers will have a hard time keeping up with the gap and publishing tenders for another 20,000 apartments by the end of the year. Also, according to industry sources, the fact that Rami director Adiel Shimron is expected to soon vacate his position after six years in the position does not really contribute to the spirit of action.

Rami has so far recorded a modest decrease of about 5.5% in its tenders. By September 22, it had deposited NIS 5.5 billion in its coffers, compared with NIS 5.8 billion in the corresponding period last year. These amounts include income from the marketing of plots in various uses, including residential, office, commercial and industrial. The decrease in revenue does not affect the state budget because revenues from the sale of state property (such as real estate or privatization of companies) do not go into the current budget, but are used to reduce the deficit or finance special projects. Not all of the 5.5 billion will be transferred to the state because some of Rami's revenue is used to finance its activities. Of the revenues so far, there is a surplus of NIS 1.5 billion that will be transferred to the government and a billion that will be paid to the JNF because Rami manages its lands.

High demand for construction

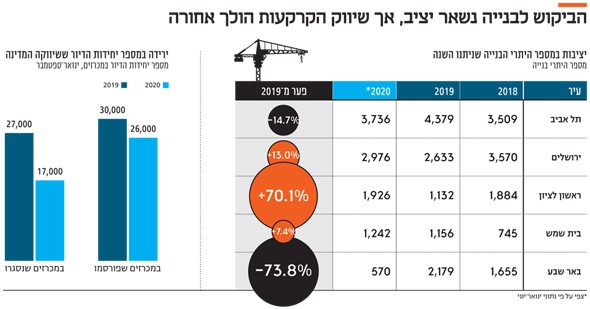

At the same time, an examination of the number of building permits issued in the first half of 2020 for the construction of apartments in the 25 leading cities in Israel shows that the market is still thirsty for land and new apartments. According to CBS data, construction entrepreneurs have continued to issue building permits at a rate no different from the rate of issuance of permits in recent years.

In Tel Aviv, permits were issued by June to build 1,868 apartments, which reflects a rate of 3,700 apartments per year, compared to 4,379 permits in 2019. Although it is only 85% compared to last year, the number is higher than in any of the four years prior to 2019. In June, permits were issued in Ramat Gan for the construction of 1,700 apartments, a rate of 3,400 apartments per year, almost double the number of permits in 2019, and significantly higher than the number of apartments in permits in each of the last five years. This is also the case in many other cities - such as Jerusalem, Ashkelon, Netanya, Rishon LeZion, Holon, Kiryat Gat and Beit Shemesh - the rate of permits is relatively high compared to previous years. In Be'er Sheva, the picture is unusual: in the first half of the year, permits were issued for the construction of 285 apartments, an annual rate of about 570 apartments - a quarter of the number of permits in 2019 and significantly lower than in previous years. These data are consistent with the failures of Rami tenders in Be'er Sheva in the past two years, and indicate an excess supply of apartments in the Negev capital.