The Marker, Hadar Horesh, 25.08.2020

Forecasts in the real estate market following the corona crisis, according to which the recession in the economy and unemployment will lower apartment prices, are not being fulfilled for the time being - but there are many data indicating a decline in construction activity and future housing shortages. their.

According to the Central Bureau of Statistics (CBS), it seems that despite the gloomy forecasts of March and April, the housing market shows signs of stability with a tendency to rise in all indices: after a cumulative decline of 0.9% in previous months of crisis, the housing index rose again in May The stability is also evident in the branches of the mortgage banks, where the rate of mortgage marketing returned to a level of NIS 6-7 billion a month and even increased slightly, probably due to the completion of transactions that were postponed during the closure period.

This is joined by the Bank of Israel 's report of a further decline in the number of customers seeking to defer mortgage payments. Banks see this as a sign that the financial strength of borrowers has been harmed less than might have been thought, and that new mortgage applicants and veteran borrowers are not among the majority of those affected by the crisis. Most people who have lost their jobs are, according to banks, younger than the average age of mortgage consumers. Even the older ones who lost their jobs have already bought an apartment, and repaid the mortgage debts.

Despite the calming signals of the mortgage banks, there may be cause for concern. The biggest threat to the mortgage market, according to the Bank of Israel, is employment stability. High non-falling unemployment rates, pressure to reduce unemployment benefits, and 11% of borrowers postponing loan repayments - four times higher than in the months before the crisis - may increase pressure on markets.

And what is happening at the forefront of the supply of residential housing units ? The CBS data on the sale of 3,665 apartments in June also reflects a record since January, when a similar number of apartments were sold. A receipt from the contractors' sales offices indicates that there is a strong demand, among other things from people who have previously waited for tenant price plans and understood that they will not continue. "

Entrepreneurs reduce activity

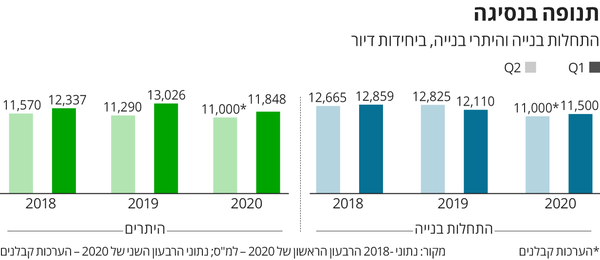

At the same time, the CBS publishes two important data that help predict future construction trends and reveal what developers really think: the scope of construction starts and the number of permits issued by contractors within a few months to a year before actual construction dropped significantly in the first quarter.

Construction starts in the first quarter of 2020 fell by 12.5% compared to the previous quarter, and amounted to only 11,500 apartments. However, it is estimated that the slump deepened in the second quarter of the year - which amounted to only about 11,000 construction starts. This is a construction rate of 43,000 apartments per year, which is much lower than the contractors' demand forecast for about 70,000 apartments per year, or the government target of about 60,000 housing units per year.

The industry claims that the closure of the economy was the main cause of the sharp decline, but it is highly doubtful whether this had an effect. The closure was imposed only in the last two weeks of the first quarter, and did not include the construction industry - which was excluded as an essential industry. On the face of it, it seems that most of the construction starts that were planned for this quarter - operations that mean fencing the area and starting excavation and dipping work - have come to fruition. In the third quarter of 2018 for example, the number of construction starts was similar. Although the volume of construction starts was small in the first quarter of 2020, it was only 5% lower than in the corresponding period last year.

Construction site in Tel Aviv, at the end of March Photo: Ofer Vaknin

Construction site in Tel Aviv, at the end of March Photo: Ofer Vaknin

A similar trend can be seen in the data on building permits, which indicate the future construction plans of the contractors. According to CBS data, the volume of building permits in the first quarter of the year amounted to only 11,848 permits, a decrease of 26% compared to the previous quarter. This figure can also be attributed to the corona crisis and the closure that followed, but this did not seem to be the problem. In the second of 2018, for example, the authorities issued a similar number of permits, without the effect of the corona, compared with the corresponding quarter last year, a decrease of 9%.

Next month, the CBS is expected to publish data for the second quarter of this year, and according to contractors' estimates, the data is expected to indicate a further decline in construction start numbers and building permits, not necessarily because of the crisis.

In the absence of a budget - the authorities are stuck

Despite complaints from contractors about the difficulty in licensing procedures, some of which are justified, it seems that one of the problems in promoting projects in the housing market actually concerns the dehydration of the main source of land in the country - tenders from the Israel Land Authority (RMI). Housing, fell in the first half of the year by 74% compared to the same period last year, and amounted to only 3,343 apartments.

Construction of a residential complex as part of a price per occupant program in the Galilee Sea Photo: Ofer Vaknin

Construction of a residential complex as part of a price per occupant program in the Galilee Sea Photo: Ofer Vaknin

The spread of the plague, the crisis and the closure imposed can explain some of the sharp decline in the volume of tenders. The crisis caused a significant reduction in the scope of Rami's work, and for a short time some developers had difficulty regulating the bank guarantees required for the submission of tenders.

Although the Minister of Housing, Yaakov Litzman, has already announced his reservations about the plan and his intentions to present an alternative plan, in practice no directive was received to stop the controversial tenders. Thus, in the midst of the economic crisis, the state continues to subsidize apartments indiscriminately. Although the price per occupant reduced the contractors' profits, it also provided a stable demand for state-subsidized apartments. The continued sale of apartments under the program is one of the reasons for market stability, despite signs of a slowdown in the economy.

The source for filling in the gaps in construction was supposed to come from the field of urban renewal , but even there the activity is faltering. In the first half of the year there were only about 2,300 construction starts under urban renewal plans, and together with the land marketed by RMI, the two main sources of new construction provide about 16% of the demand estimated by the contractors, or less than 20% of the target set by Ministry of Finance - which amounts to 60,000 apartments a year.

Many urban renewal projects have been frozen in complicated planning procedures, in part because of poor infrastructure planning. The Urban Renewal Authority set up by the previous government has also stalled, and now suffers from a lack of an adequate budget. The new government has decided to transfer hundreds of millions of shekels to the program to advance plans, but like other budgetary decisions, the move is delayed.

The apparent shortage of new construction is expected to affect the market at least in the short term. On the other hand, the demand for apartments will continue to depend on the economic situation of the buyers, which may also worsen in the near future.