Hadar Horesh, themarker.com

The housing market is heating up: The number of deals in new apartments is jumping, mainly due to a price plan for the consumer - which now accounts for 53% of the new housing market. However, significant increases are also recorded in free market transactions. Among the contributors to the global warming are investors in apartments, despite the stated policy designed to discourage them. This is evident from the Chief Economist's review of the Treasury.

According to past experience, data on pre-transaction growth is data on price increases. In fact, the Central Bureau of Statistics has already reported a rise in house prices in the third quarter of this year.

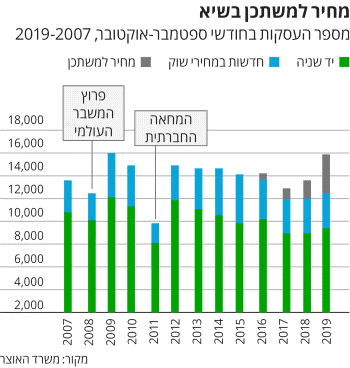

Residential apartment sales broke a record in September-October, boosting sales of new apartments in the market by 18% over the same period. A total of 15,900 apartments were purchased in these two months. Excluding the plan, the rate of increase in transactions was only 4%. Second-hand apartment sales led to the increase in free-market deals in September-October, with a 5% climb compared to the same period last year.

In a regional analysis of home sales, Netanya stood out with a 12% drop in second-hand deals, compared to an 8% -10% jump in the other major cities.Among the major contributors to the rise in activity in the industry are housing enhancers, who hardly qualify for a price plan for their residents. September-October housing enhancements totaled 5,300 apartments, a 9% jump over the same period last year. In a geographical segment, Rehovot shows a 23% increase in housing enhancement purchases, given the relatively high rate of housing enhancers in this area.

A homeowner price plan primarily affects the new home buyers' market and makes it difficult for housing enhancers to sell their old one. This phenomenon has in the past led to a slowdown in demand from housing enhancers, but data from the chief economist indicate that the effect of the government program has weakened.

The figures indicate further recovery in the sale of investment apartments. However, investors continue to sell apartments - and the stock of rental apartments continues to decline. About 21,000 apartments were down from inventory from April 2016 to October this year. According to the review, investor purchases have increased by 3% over the same period last year, and the economist suspects that the real estate market is still attracting black capital.

Construction in Beit Shemesh Photo: Eyal Toeg

Investments in September-October totaled 1,800 apartments and sold 2,600. As a percentage of total transactions, the weight of investor purchases in September-October this year was 11% - two percentage points lower than in the same period last year. Investors' level of salary analysis indicates the existence of unreported capital (whether by law - for new immigrants, or not).

Chief economist at the Treasury, Shira Greenberg Photo: Eyal Toag

The activity of home buyers for investment purposes has increased over the past decade, in view of the fall in interest rates and the decrease in return on other investment channels. With the entry of Moshe Kahlon into the position of Finance Minister, the purchase tax on investment apartments was raised and a special tax was imposed on third-party owners. The measures are intended to get investors in apartments out of the buyer’s circle and to help lower housing prices. As a result of these moves, the stock of rented apartments has dropped and rent has risen. Investors' activity did not decrease as a result of the measures and much of their activity went abroad. As a result, the Treasury lost hundreds of millions of NIS in tax revenue.