Hadar Horesh, themarker.com

The housing market returns to the procedure: strong demand, reduction in supply and expectation of price increases — this is the case of data published by the Central Bureau of Statistics (the CBS) and an analysis conducted in the bank of Leumi's economy wing. The CBS data has indicated a decrease in the price average of the new apartments, as a result of an increase in the sales scale of the price plan for the dip, but the low prices of the subsidized apartments were unable to stop the increase at the average price.

The data shows that most of the purchasers of the apartments — who are not entitled to the price and are not included with a handful of the magrilim — the prices of the apartments are less than the above, at a rate similar to the rate of price increase that was before the current government began its long term.

During the transitional Government, the housing staff tried to present business as usual and to continue promoting the flagship program, a price to be transported. The activity has not been interrupted and has not been formally slowed down, but beneath the surface there is a considerable change. The majority of the government land reserves available to the program are located in the far periphery, in which there is no shortage of apartments at reasonable prices. As a result, most of the land marketing, and the Israel Land Authority (RAHAROR), ceased additional tenders.

In demand areas, apartments can be reduce by means of discounted ground marketing, but the government has no significant land reserves. The result is a considerable decline in the marketing of residential land in the second half of the year. In addition, the scope of the marketing of land intended for the price apartments to be transported. In an attempt to increase the value of tenders, the plots are marketed with the possibility of selling 20% – 50% of the apartments in the free market.

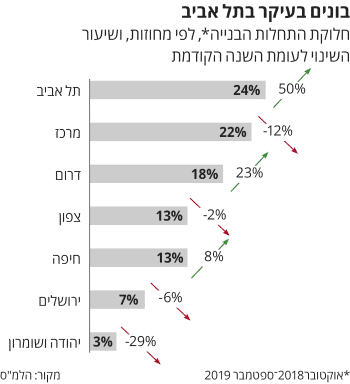

Building mainly in Tel Aviv

Building mainly in Tel Aviv

A substantial portion of the future apartment offerings that will increase the increasing demand for new dwellings should come from the urban renewal sector. However, the recent period is characterized by increasing difficulties in this area on the backdrop of considerable retardation in building infrastructures, freezing government development budgets and decisions by local authorities to detain permits and marketing land for planning and budgetary parties.

Delays and difficulties in realizing urban renewal programs have woken up in central demand areas, such as Ramat Gan, Givatayim, Herzelya, Bat Yam and Netanya. The uncertainty contributed to the intention to cancel TAMA38, before a clear alternative was formulated.

Data published yesterday the Central Bureau of Statistics teaches an interesting recovery at the pace of the construction starts. In the 12 months between august 2018 and september 2019, the construction of the 52 thousand apartments began, an increase of 8% compared to the previous 12 months. In addition, the apartments have also risen, about 6%. Except that these positive figures are joining two warning comments.

The analysis of the data conducted by the Central Bureau of Statistics teaches a decrease in the construction beginnings at a rate of 4% per quarter, as opposed to the rising trend observed throughout 2018. This means that even though the sum of the 12 months was positive, the main improvement was recorded at the beginning of the period, and the conclusion of the construction starts in 2019 would be less positive than the published data so far.

Another given published indicates a decrease of approximately 5% at the rate of construction permits. The building permits are issued by the local authorities and greatly determine the rate of construction starts. The data indicates that the rate of construction permits continues to decline, after last year, the decline in the elections held to the local authorities.

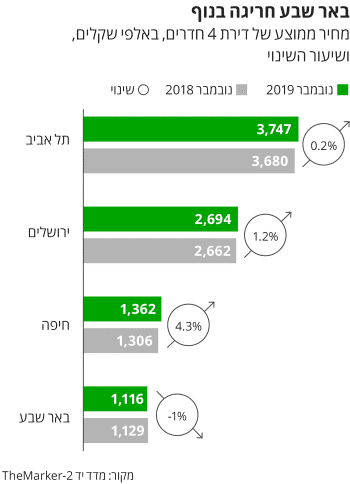

Be'er Sheva exceptional in the landscape

Be'er Sheva exceptional in the landscape

In the first nine months of 2019, 38 thousand building permits were issued — a figure reflecting an annual rate of 51 thousand permits, compared to about 55 thousand permits in 2018. According to estimates, the permit issuance will continue to fade in the last quarter of 2019, among other things due to the budgetary improvements during the transitional Government.

Prices will continue to climb

At Bank Leumi, the final measure of the prices of the apartments — a real cost (by the price index) at 1% — will continue to rise, at least in the near future. These estimates are based on the trend of recent indicators and the signs of growing activity in the industry, which affects the prices of the apartments: the sales scale of new apartments arrived in October to a record level of 3,029 apartments (seasonally adjusted data). This figure reflects a 23% increase in relation to the previous month, and a sharper increase of 37% compared to October 2018.

The accumulated sales of new dwellings in the first ten months of the year (January-October) amounted to 26 thousand apartments — a high number in relation to the corresponding periods in the 2016 – 2018, which indicates a considerable increase in the activity in the real estate market. The activity in the new dwellings market is located on a continuing ascent from the end of 2018. The current level of activity is located in a similar environment to the high level recorded in 2015.

Kiryat Ata Photo: Ilya Melnikov

Kiryat Ata Photo: Ilya Melnikov

According to the above, the number of transactions carried out in the price framework of the market increased and constitutes 52%, compared to 50% in the previous period (August-September), which contributed to the current increase in the activity in the housing market. The increase in activity at present, combined with the trend of decline in inventory apartments for sale (reflecting a slow growth in supply), supports the continuation of the development of pressure for the short-term price increases.

Also, the " the marker " test indicates that the extent of the sale of the apartments is a preliminary indicator (in two to three quarters) to the price of housing. Therefore, the continuation of the current trend is expected to lead to an increase in the rate at the annual increase of housing prices, but probably not as sharp as it was in previous years.

At a longer glance, a different development is expected at prices between the areas of demand, in which a shortage of apartments may develop, in the other areas of the country.

The "Themarker" index, which provides data on the price quotations for the apartments, teaches that in November they did not stop the apartment prices. The index is based on the prices requested by the apartment sellers, according to the sales ads posted on the sites. These prices are not necessarily the prices of actual transactions, but the changes in prices preach the mood and the familiar expectations that are often aware of the value of the assets in theirhands.

The index to November reflects a decline of 0.8% at the average prices in Jerusalem, and an increase in most other areas. In Tel Aviv, the rise amounted at 0.5%, and so is the almost all of the nearby periphery, except Givatayim — where a 2.7% leap was recorded. The bat-Yam fell in 0.2%, with which Ramat HaSharon joined with 5.1% — an unreasonable decline, which apparently stems from a minority of deals.

Building in Beit Shemesh Photo: Eyal Touag

Building in Beit Shemesh Photo: Eyal Touag

Haifa, which is also the price declines according to the meter, continues to deteriorate according to the CPI-Themarker. In November the city's index in 0.4%. However, it should be noted that at least according to the CPI-Themarker, The city leads the rise in the prices of the apartments in major cities, with an annual increase of 4.3%.

The state of Haifa does not radiate its surroundings. In Kiryat Motskin, prices were raised at 0.4%, in Kiryat Ata and Kiryat Motzkin prices increased by 2% on average. In Tiberias the prices for the apartments were raised in 2.1%, and in Karmiel, which suffered an increase in the supply of new apartments, 2.4% was recorded. The price increases trend is also renewable in the South, with an increase of 1.5% in Be'er Sheva and 0.4% in Ashkelon.

The renters have been forgotten

In the field of rental, The index reveals the price of 1% on average in Tel Aviv, Ramat Gan and Givataim. It should be noted that November — the index is a weak month in the field of rental, since this market tends to increase its activities mainly during the summer and autumn months.

In summary of the current year (November 2018 – November 2019) reflects the "themarker " of the data that is also observed according to other sources, and mainly the M. M. Measurements: This year is the price of light prices in most areas, led by the areas of demand. Our increased increases, mainly due to the temporary braking and declines in the middle of the year; as well as the price to be transported, that started affecting the apartment market in the new apartment sector. However, there were those who paid the price of success: the prices in the free apartment market, especially in the new apartment market, were sharper than the average indices.