Unusual payment requirement recently landed in mailboxes of residents of an old building in the heart of Tel Aviv District 3: Pets apartments in the building were told that they must pay the Municipality of Tel Aviv-Jaffa betterment levy of $ 1.3 million, for registration as a condominium building.

Betterment tax required by the city after the tenant’s lessees’ generations already listed building - sought to register the building as a condominium and arranged by the historic partnership mechanism applies to property that characterizes the registration of hundreds of apartment buildings throughout the city. Payment request issued by the Local Planning and Building argued that joint listing request is the realization of asset enhancement.

This is an old building and a 4-storey building located at the heart of Ruth 8 3 City borough - covering an area of approximately 500 sq. In this building, as hundreds of residential buildings constructed in the city in the 40s and 50s of the last century - with the establishment registered ownership using "smooth lump company." subject to this mechanism, the apartments in the building are not registered in the land Registry City-hall, as is common today - but with apartments in the building holding shares in a listed company, in partnership with the developer, as well as a perpetual lease rights on the ground. this mechanism is a legal arrangement created tax purposes at the time of that time, when in fact there is no difference between the rights of an apartment building owner and rights holder such an apartment in normal.

A year ago, the residents decided to cease the registration of historical method and to register the building by way of a common house registration, to make it easier in future sale transactions registration field. Because each register of this kind required tax certificates, contact tenants, inter alia, the Tel Aviv municipality to receive approval of the municipality and the local committee for registration of the building as a condominium - but 'pursuit led to demand payment dramatically from the municipality , which means payment of $ 100 thousand shekels per housing unit, power district 3 program, which took effect at the beginning of 2018, the municipal system.

When contacted seeking clarification on the issue, said the municipality is going to request that the base of the dissolution of a procedure during which the owners become lessees of land - which is the realization of land rights, for which can be systematically collect betterment levy. "Dismantling company and making lessees of landowners, including adherence committed, constitute the exercise of rights in land, bringing with him betterment levy liability," the language of the municipality's response.

"Not created any enrichment owners"

Following the reply, filed tenants of the building last week an appeal to the Appeal Committee compensation and betterment levy Tel Aviv, against the levy, Attorney Ariel Konkobitz, and said it is not possible to charge a levy betterment application for registration of a condominium because there is no registry of action that realizes improvement. According to them, as opposed to sale or issuance of a building permit, do not make any enrichment as a result of the design of the authority, only be possible law require improvement tax. Alternatively, it is argued in the appeal that if the registration of a condominium was considered a transfer of rights, then this transfer by operation of law such as inheritance or consolidation and distribution, which is not considered a realization of the rights for the purpose of betterment levy.

"Even if the claim took place in a building on Ruth the use of land as a result of a voluntary liquidation of the company and the transfer of rights to the shareholders, and that since the tenants were already tenants registered in the land, each in relation to his apartment and in accordance with the draft land registration, transfer of ownership to the lessee is registered in the land as the building , does not constitute the exercise of rights. this is because ownership in this case of a lease for 99 or 999 years had stripped and exists only on paper, and in any case before the registration of the condominium principal debtor betterment levy was the lessee, will continue to be to levy after it - so no here fear that there will be those who collect the levy recoverable Ha respect to the past, "said Mr. Konkobitz.

The appeal letter also showed that even if the exercise of rights event was voluntary liquidation process of a smooth and lump company land transfer to its shareholders - the tenants, there is still no transfer of rights existed incidentally dissolution and liquidation actually not even started. Apartment owners also argue that the municipality and the local committee determined the exceptional levy requirement ignoring its decision of Cote Boaz vast assessor December 2018, can be attributed to one of the apartments in the same building on Ruth.

In that case, the owners of the local committee demanded apartment area of 62 square meters betterment levy at about -235 thousand shekels under the same program (Program District 3) - but the vast assessor stated unequivocally that there has been no improvement on the building, and completely delete the requirement betterment levy.

"Step, even for the municipality"

"It is unacceptable that Tel Aviv, acting as a municipal public trustee, committed to enhanced learning of good faith, rather than to act with maximum transparency, hide taxpayer information so critical," says attorney Konkobitz. "The demand accepted this precedent, hundreds of old buildings north Tel Aviv and the city center, whose owner is registered in the name of companies Gush-halkah, and seeking to regulate their registration as a condominium, exposed to considerable improvement fees only procedural due process. This step, even for the municipality, which is trying in every way to enrich the coffers at the expense of landlords, as unfortunately, her goal justifies all means. "

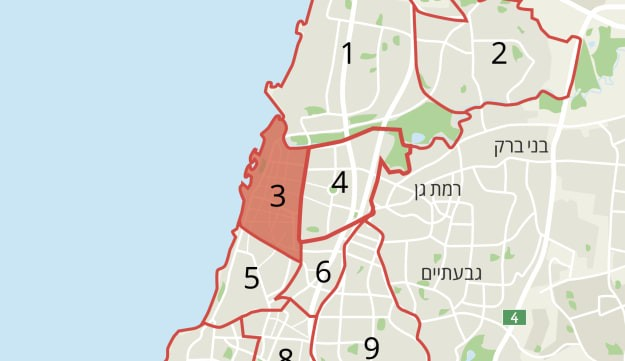

District 3 is the old district was built in the 30s and 40s according to the Geddes plan and extends between Hayarkon Street West, Bograshov, Ben Zion and Marmorek South, East and Ibn Gabirol Yarkon River Yarkon River in the north. District 3 also prominent longitudinal axes commercial featuring Ben Yehuda, Dizengoff and Ibn Gabirol eastern boundary. There are also useful and hotel resorts along the Hhof.al according to municipal statistics, the average house size is about 67 square meters, lower than the city average (80 square meters) and only about 28% of households that live in dwellings they own, compared to 44.8 % each city.

Tel Aviv municipality said in response: "Contrary to what is claimed, it is not a request for registration but please liquidation of the company. According to the Planning and Construction, dismantling construction and making the tenants to owners of land constitute the exercise of land rights brings with it obligations improvement fees, which stated in accordance with the law".